The ongoing Ripple XRP lawsuit has captured the attention of the entire cryptocurrency community. This legal conflict between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) has left investors and enthusiasts uncertain about the future of XRP and the broader crypto industry. As the case continues to unfold, gaining a thorough understanding of its implications is essential for anyone involved in the crypto ecosystem.

Since December 2020, Ripple Labs has been engaged in a high-profile legal battle with the SEC. The SEC alleges that Ripple sold XRP tokens as unregistered securities, which they claim violates federal securities laws. The outcome of this case could have profound effects, not only for Ripple but also for the entire cryptocurrency market.

This article aims to provide a detailed examination of the Ripple XRP lawsuit. We will explore the key elements of the case, its potential impact on the crypto market, and what it means for investors. Whether you're a seasoned crypto expert or a newcomer to the space, this guide will assist you in navigating the complexities of this significant legal dispute.

Read also:Marquette Vs New Mexico A Comprehensive Analysis

Table of Contents:

- Ripple Labs: The Company Behind XRP

- A Closer Look at the Ripple XRP Lawsuit

- The SEC's Allegations Against Ripple

- Ripple's Legal Defense Strategy

- Legal Precedents and Broader Implications

- The Lawsuit's Influence on the Cryptocurrency Market

- What the Lawsuit Means for Investors

- The Future of Ripple and XRP

- Regulatory Challenges in the Crypto Industry

- Conclusion and Next Steps

Ripple Labs: The Company Behind XRP

Ripple Labs, established in 2012, is a pioneering force in the blockchain and cryptocurrency sector. Based in San Francisco, Ripple is dedicated to transforming global payments through its cutting-edge blockchain technology and the XRP digital asset.

Ripple's Origins and Core Mission

Ripple was co-founded by Chris Larsen and Jed McCaleb with the vision of enabling instantaneous, secure, and cost-effective cross-border transactions. The company's mission is to provide financial institutions with efficient and scalable solutions to revolutionize international money transfers.

Notable Milestones in Ripple's Evolution

- 2012: Ripple Labs is founded, marking the beginning of its journey in the blockchain industry.

- 2013: The XRP Ledger is launched, introducing XRP as a digital asset designed to facilitate rapid and affordable transactions.

- 2015: Ripple forms partnerships with major banks, underscoring its growing influence in the financial sector.

- 2020: The SEC files a lawsuit against Ripple, initiating a legal battle that remains ongoing.

A Closer Look at the Ripple XRP Lawsuit

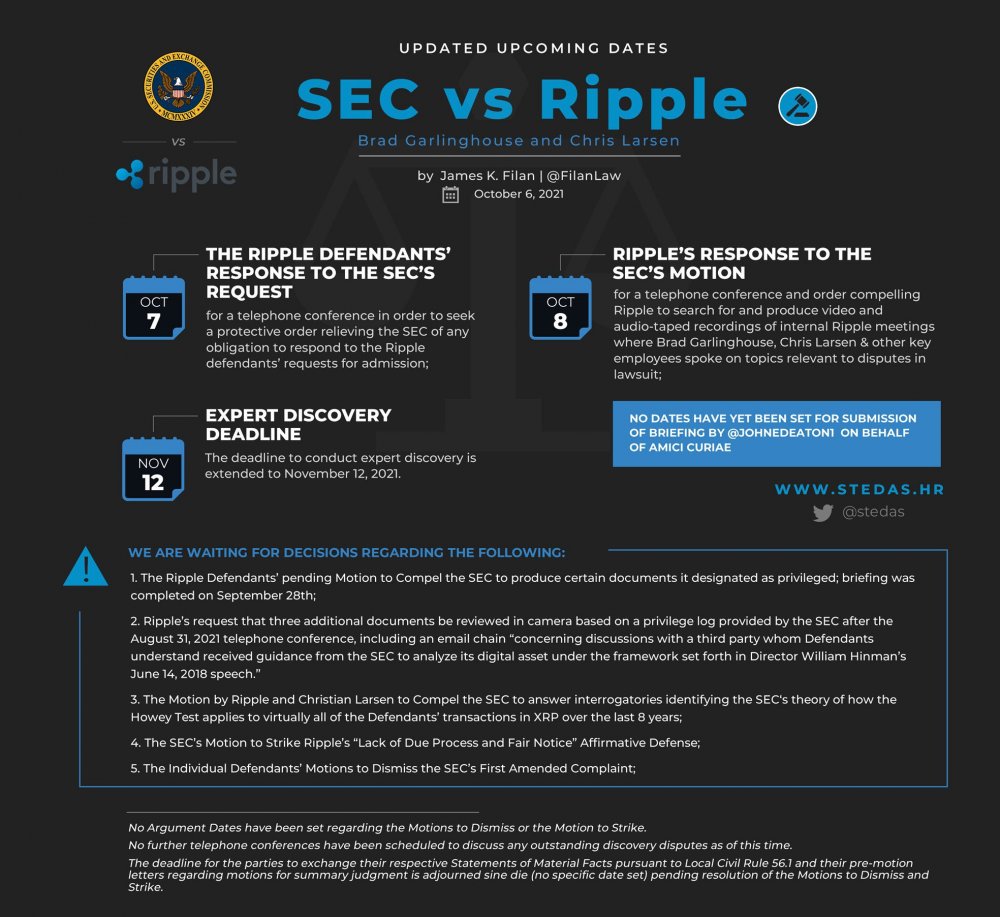

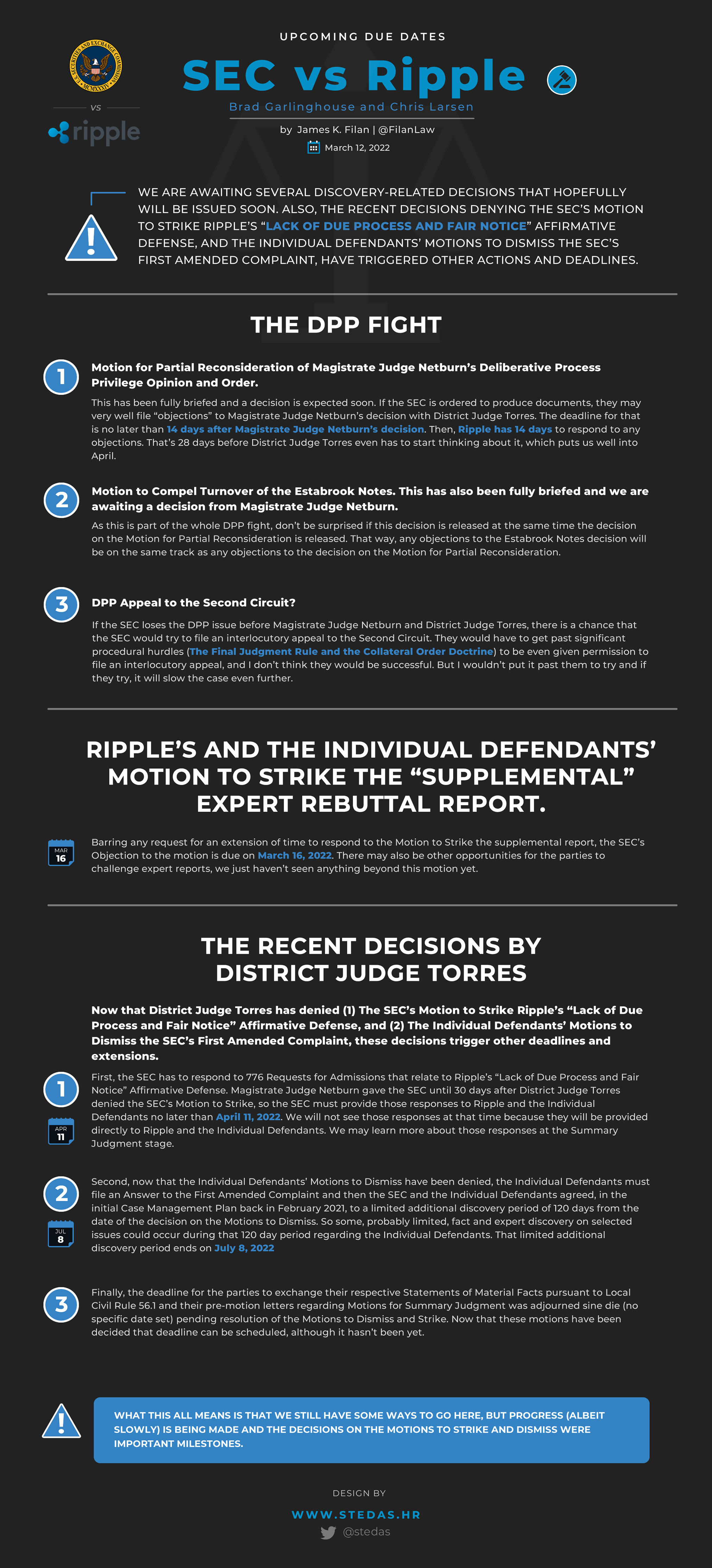

The Ripple XRP lawsuit commenced in December 2020 when the SEC filed a complaint against Ripple Labs. The SEC accused Ripple of conducting an unregistered securities offering by selling XRP tokens. This case has since become a central topic of discussion in the realm of cryptocurrency regulation.

The Key Parties Involved in the Lawsuit

- Ripple Labs: The defendant in the case, represented by a team of skilled legal experts.

- SEC: The plaintiff, arguing that XRP should be classified as a security under federal securities laws.

- Brad Garlinghouse and Chris Larsen: Ripple's CEO and co-founder, respectively, who are also named as defendants in the lawsuit.

The SEC's Allegations Against Ripple

The SEC contends that Ripple breached federal securities laws by selling XRP tokens without registering them as securities. According to the SEC, XRP satisfies the criteria of an investment contract as defined by the Howey Test, necessitating proper registration.

The Howey Test and Its Application to XRP

The Howey Test, established by the Supreme Court in 1946, determines whether a transaction constitutes an investment contract. The SEC asserts that:

Read also:Blake Shelton A Country Music Icon And Entertainment Powerhouse

- Investors provided funds to Ripple in exchange for XRP tokens.

- Ripple promised investors profits stemming from its efforts to develop the XRP ecosystem.

- The investment was connected to a collective enterprise, with Ripple playing a pivotal role in its success.

Ripple's Legal Defense Strategy

Ripple has mounted a robust defense, arguing that XRP is not a security but a utility token designed to facilitate fast and efficient transactions. The company highlights that XRP operates independently of Ripple and is utilized by third parties for purposes beyond investment.

Ripple's Key Defense Arguments

- XRP is a decentralized digital asset, not controlled by Ripple or any single entity.

- Other cryptocurrencies, such as Bitcoin and Ethereum, are not classified as securities despite sharing similarities with XRP.

- Ripple's use of XRP aligns with its role as a payment token rather than an investment vehicle.

Legal Precedents and Broader Implications

The Ripple XRP lawsuit carries significant implications for the cryptocurrency industry, as it establishes a precedent for how regulators classify digital assets. The case's outcome could influence future regulatory frameworks and shape the trajectory of the crypto market.

Possible Outcomes and Their Effects

If the SEC prevails, it could result in stricter regulations for cryptocurrencies, potentially impeding innovation in the space. Conversely, a victory for Ripple could provide clarity and foster greater adoption of digital assets.

The Lawsuit's Influence on the Cryptocurrency Market

The Ripple XRP lawsuit has significantly impacted the cryptocurrency market, causing volatility in XRP's price and affecting investor sentiment. As the case progresses, market participants remain cautious, awaiting a resolution that could determine the future of XRP and other digital assets.

XRP's Price Fluctuations During the Lawsuit

Since the lawsuit was initiated, XRP's price has experienced substantial fluctuations. According to data from CoinMarketCap, XRP's value plummeted immediately after the lawsuit was filed but has partially recovered as the case evolves.

What the Lawsuit Means for Investors

For investors, the Ripple XRP lawsuit presents both challenges and opportunities. While the legal uncertainty may discourage some from investing in XRP, others see potential in the token's utility and long-term prospects.

Key Factors for Investors to Consider

- Assess the legal risks associated with investing in XRP during the lawsuit.

- Consider the token's utility and adoption by financial institutions as a payment solution.

- Stay informed about developments in the case and their potential impact on XRP's value.

The Future of Ripple and XRP

The future of Ripple and XRP depends on the outcome of the lawsuit. A favorable ruling for Ripple could enhance confidence in XRP and accelerate its adoption, whereas a loss could lead to regulatory hurdles and market uncertainty.

XRP's Long-Term Potential

Despite the ongoing legal battle, XRP holds considerable potential as a payment token. Its capacity to facilitate swift and low-cost transactions makes it an appealing option for financial institutions seeking to enhance cross-border payments.

Regulatory Challenges in the Crypto Industry

The Ripple XRP lawsuit underscores the broader regulatory challenges confronting the cryptocurrency industry. As digital assets gain prominence, regulators worldwide are working to determine how best to classify and govern them.

Global Developments in Cryptocurrency Regulation

Countries such as Japan and Switzerland have adopted progressive approaches to cryptocurrency regulation, providing clarity and promoting innovation. In contrast, jurisdictions like the U.S. continue to debate the optimal method for regulating digital assets.

Conclusion and Next Steps

The Ripple XRP lawsuit marks a crucial moment for the cryptocurrency industry, with far-reaching consequences for both Ripple and the broader market. As the case progresses, staying informed and understanding its potential impact is vital for anyone involved in the crypto space.

We invite readers to share their thoughts on the lawsuit in the comments section below. Additionally, explore our other articles for further insights into the world of blockchain and digital assets. Together, let's navigate the complexities of the crypto landscape and help shape its future.